Car title loans in Mineral Wells, Texas provide fast cash with attractive rates and flexible terms, ideal for diverse borrowers. Secured by vehicle equity, these loans offer minimal paperwork and credit checks. Borrowers retain vehicle possession while the lender holds the title as collateral until repayment. Refinancing options are available, making them a convenient choice for immediate financial needs. Interest rates vary based on vehicle value, condition, loan duration, and borrower's credit history, emphasizing the importance of comparing offers from multiple lenders.

“Uncovering the Ins and Outs of Car Title Loans in Mineral Wells, TX: Interest Rates Decoded provides a comprehensive guide to understanding this financial option. We explore the fundamentals of car title loans, delving into how interest rates are calculated in the local context of Mineral Wells, TX.

This article breaks down the factors influencing these rates, offering insights for informed decision-making. Whether you’re considering a loan or just curious, discover the key elements that determine the financial burden of car title loans in your area.”

- Understanding Car Title Loans: A Brief Overview

- How Interest Rates Are Calculated for Car Title Loans in Mineral Wells, TX

- Factors Influencing Interest Rates on Car Title Loans: A Closer Look

Understanding Car Title Loans: A Brief Overview

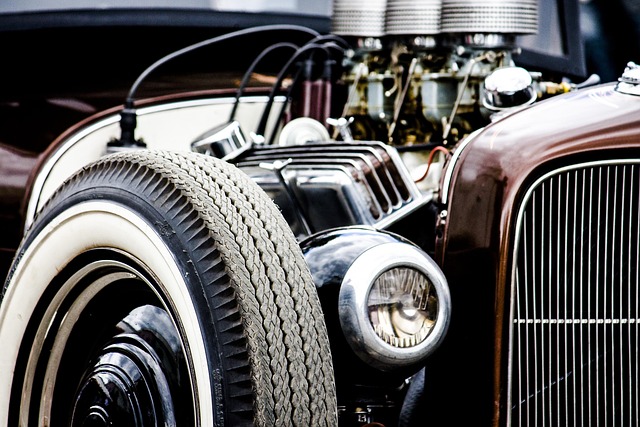

Car title loans Mineral Wells TX have gained popularity as a quick source of financial assistance for individuals who own their vehicles. This type of loan uses the vehicle’s equity as collateral, allowing lenders to offer competitive interest rates and flexible terms. Unlike traditional bank loans, car title loans require minimal paperwork and credit checks, making them accessible to a wide range of borrowers.

In this process, borrowers hand over their vehicle’s title to the lender until the loan is repaid. This ensures the lender has a clear claim on the vehicle, but it doesn’t necessarily mean ownership transfers. Loan refinancing options are also available for those who need more time to repay or want to secure better terms based on improved financial situations. By leveraging their vehicle equity, Mineral Wells TX residents can access immediate financial assistance without the stringent requirements of other loan types.

How Interest Rates Are Calculated for Car Title Loans in Mineral Wells, TX

Car title loans Mineral Wells TX work by assessing the value of your vehicle and setting an interest rate based on that appraisal. Lenders consider factors like the make, model, year, and overall condition of your car when determining the loan amount and interest rate. The interest is then calculated as a percentage of the outstanding loan balance over the agreed-upon Loan Terms. It’s crucial to understand these terms, which can vary from lender to lender, and can impact how much you pay in total for the loan.

During the application process, a vehicle inspection is typically required. This step ensures the accuracy of the initial vehicle assessment and can influence the final interest rate offered. Once approved, borrowers should carefully review the loan agreement, understanding the interest calculation methodology and any potential fees associated with early repayment or missed payments to ensure a smooth Loan Payoff experience.

Factors Influencing Interest Rates on Car Title Loans: A Closer Look

When considering a Car Title Loan Mineral Wells TX, understanding interest rates is paramount. Several factors play a crucial role in determining these rates. The primary ones include the loan amount requested, the type of vehicle used as collateral, and the lender’s specific policies. Generally, larger loan amounts incur higher interests due to increased risk for the lender. Additionally, the condition and value of your vehicle during the inspection process significantly impacts the interest rate offered.

The loan approval process also influences interest rates. A strong credit history can lead to more favorable terms, while a less-than-perfect credit score may result in higher interest rates. Lenders assess your ability to repay based on these factors, and they often factor in the duration for which you need the loan. Moreover, credit check procedures are standard, as they help lenders gauge your financial reliability. Remember that transparency is key; comparing multiple offers from different lenders can help secure the best possible interest rate for your Car Title Loan Mineral Wells TX.

Car title loans Mineral Wells TX offer a quick solution for emergency funding, but understanding the interest rates is crucial. This article has provided an overview of the calculation process and the factors that influence these rates, empowering borrowers to make informed decisions. By considering the interest rates and the associated factors, you can navigate the loan process with confidence, ensuring the best possible terms for your car title loan in Mineral Wells, TX.