Car title loans Mineral Wells TX offer quick cash secured by your vehicle's title, catering to individuals with less-than-perfect credit and flexible terms. Lower interest rates are achieved through collateralization, with factors like loan amount, creditworthiness, term, and possession of the vehicle (Keep Your Vehicle) influencing rates. Reputable lenders provide same-day funding, customizable repayment plans (weekly/bi-weekly), and extended terms, emphasizing informed decision-making by thoroughly reviewing all terms and conditions.

Car title loans in Mineral Wells, TX, offer a fast cash solution secured by your vehicle. Understanding the interest rates for these loans is crucial before borrowing. This article breaks down how interest rates are determined and what you need to know about repayment options. If you’re considering a car title loan in Mineral Wells, TX, this guide will equip you with the insights to make an informed decision, ensuring you get the best terms possible.

- Understanding Car Title Loans in Mineral Wells, TX

- How Interest Rates for Car Title Loans Are Determined

- What You Need to Know About Interest Rates and Repayment Options for Car Title Loans Mineral Wells TX

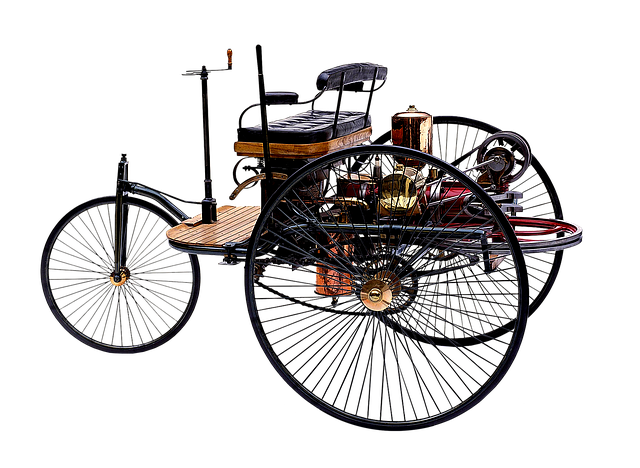

Understanding Car Title Loans in Mineral Wells, TX

Car title loans Mineral Wells TX are a type of secured loan where your vehicle’s title acts as collateral. This means that the lender has the right to repossess your car if you fail to repay the loan according to the agreed-upon terms. However, this doesn’t necessarily mean you’ll lose ownership; many lenders offer flexible payment plans tailored to borrowers’ financial capabilities. The process typically involves providing your vehicle’s title and potentially facing a shorter approval time compared to traditional loans.

Unlike Fort Worth loans, which might have stringent requirements, car title loans Mineral Wells TX often cater to individuals with less-than-perfect credit. The key advantage lies in the use of your vehicle as security, making it an attractive option for those needing quick access to cash. With a clear understanding of the terms and conditions, including interest rates and payment plans, borrowers can make informed decisions about this alternative financing method.

How Interest Rates for Car Title Loans Are Determined

The interest rates for Car Title Loans Mineral Wells TX are determined by several key factors. Lenders consider the loan amount, the value of your vehicle, and your creditworthiness when setting these rates. The primary advantage of car title loans is that they often have lower interest rates compared to traditional personal loans, as the lender has a clear security interest in your vehicle, which acts as collateral. This reduces risk for the lender, thereby offering more favorable terms to borrowers.

Additionally, the term of the loan plays a significant role in Interest Rates. Shorter-term loans typically come with higher rates due to the increased frequency of payments and the potential for default. Lenders also assess the administrative costs associated with processing these types of loans, which can influence the final interest rate offered. Keep Your Vehicle remains a priority for borrowers, as it ensures the lender retains access to the vehicle in case of non-payment, further securing the loan and potentially keeping rates competitive. Direct Deposit is another convenience that lenders may factor into their pricing structure, streamlining both the borrowing process and ensuring timely repayment.

What You Need to Know About Interest Rates and Repayment Options for Car Title Loans Mineral Wells TX

When considering a car title loan in Mineral Wells TX, understanding interest rates and repayment options is crucial for making an informed decision. Interest rates can vary significantly between lenders, so it’s essential to shop around and compare offers. Many reputable lenders now offer same-day funding, providing financial assistance when you need it most. This rapid turnaround time can be a significant advantage, especially in emergencies or unexpected financial situations.

Repayment options also play a vital role. Most car title loans have flexible repayment plans tailored to fit your budget. You may opt for weekly or bi-weekly payments, making the process more manageable. Additionally, some lenders offer the convenience of extended terms, which can lower your monthly payments but extend the overall cost of the loan. Remember, transparency is key; review all terms and conditions before committing to a car title loan in Mineral Wells TX to ensure it aligns with your financial capabilities.

Car title loans Mineral Wells, TX, can provide quick financial support, but understanding interest rates is crucial. Lenders determine these rates based on factors like loan amount, vehicle value, and repayment term. Repayment options often include weekly or bi-weekly payments, ensuring manageable installments. Before securing a car title loan, carefully consider the interest rate, choose a reputable lender, and confirm your ability to repay to avoid financial strain.