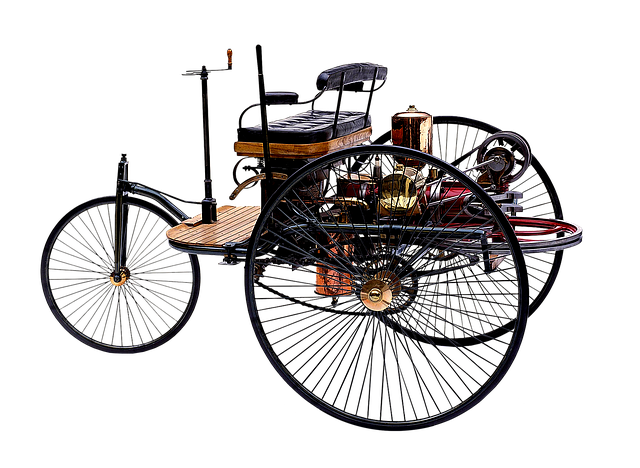

Car title loans Mineral Wells TX offer quick cash for borrowers but require eligibility proof like a valid driver's license, Texas residency, and vehicle ownership without liens. The process involves document preparation, including IDs, utility bills, titles, and income proof. Comparing lenders is crucial to get the best deal with fair terms, especially for bad credit loans in Mineral Wells, TX, by checking APR and customer reviews.

Looking for a fast financial solution in Mineral Wells, TX? Car title loans could be an option. Before you apply, understand the eligibility criteria and gather the required documents, such as your car’s title, ID, and proof of income. Compare lenders to find the best rates and terms tailored to your needs. This strategic approach ensures you secure a favorable car title loan in Mineral Wells, TX, providing access to funds when you need them most.

- Understand Eligibility Requirements for Car Title Loans Mineral Wells TX

- Gather Necessary Documentation for Car Title Loans Mineral Wells TX

- Compare Lenders and Terms for Optimal Car Title Loan in Mineral Wells TX

Understand Eligibility Requirements for Car Title Loans Mineral Wells TX

Car title loans Mineral Wells TX are a popular choice for borrowers looking for quick cash. However, before applying, it’s crucial to understand the eligibility requirements set by lenders. These requirements vary slightly between lenders but generally include having a valid driver’s license and proof of residency within the state of Texas. Additionally, you must own a vehicle free of any outstanding liens or significant repairs that could impact its value. Lenders will also conduct a thorough vehicle valuation to determine the loan-to-value ratio, which affects the amount of credit extended.

Another important consideration is your credit history, especially when it comes to bad credit loans Mineral Wells TX. While traditional loans often require excellent credit, car title loans offer an alternative for those with lower credit scores due to their collateralized nature. This means that if you own a vehicle with substantial equity, even with poor credit, you may still qualify for a loan. Dallas title loans, for instance, are known for their accessibility, as they prioritize the value of your vehicle over strict credit checks. The process involves providing documentation related to your vehicle’s registration and insurance to facilitate the evaluation of its valuation.

Gather Necessary Documentation for Car Title Loans Mineral Wells TX

When applying for Car Title Loans Mineral Wells TX, ensuring you have all the necessary documentation is key to a smooth process. Lenders will require proof of your identity and residency, typically through government-issued IDs like driver’s licenses or passports, along with utility bills or lease agreements. For the vehicle itself, you’ll need the title, which serves as security for the loan—a crucial element in securing Car Title Loans Mineral Wells TX.

Additionally, lenders often ask for proof of income to assess your Loan Eligibility. This can include pay stubs, tax returns, or bank statements. Some may also request a clear vehicle history report to verify the condition of your car and ensure it meets the standards for Dallas Title Loans. Having these documents ready demonstrates your preparedness and increases your chances of qualifying for the desired Car Title Loans.

Compare Lenders and Terms for Optimal Car Title Loan in Mineral Wells TX

When considering a car title loan in Mineral Wells, TX, one of the most crucial steps is to compare lenders and their terms. This process allows borrowers to secure the best possible deal tailored to their financial needs. There are numerous lenders offering car title loans in this area, each with varying interest rates, repayment periods, and requirements. By comparing these factors, individuals can choose a lender that aligns with their budget and offers favorable terms. For instance, some lenders may have lower interest rates but longer loan durations, while others might provide shorter repayment plans with slightly higher rates.

Understanding the loan terms is essential for managing expectations and avoiding hidden fees. Borrowers should pay close attention to the annual percentage rate (APR), which reflects the true cost of borrowing. Additionally, checking the lender’s reputation and customer reviews can offer insights into their reliability and transparency. This step ensures that individuals receive fair treatment, especially when dealing with bad credit loans in Mineral Wells, TX, as a good comparison can help secure a loan approval process that is both efficient and beneficial.

Car title loans Mineral Wells TX can be a viable option for those needing quick cash. By understanding the eligibility requirements, gathering the necessary documentation, and comparing lenders, you can secure the best terms for your situation. Remember to choose a reputable lender and thoroughly review the loan agreement before signing. This strategic approach will ensure a smooth process and favorable outcomes when pursuing car title loans Mineral Wells TX.